The Rise of Decentralized Finance: A New Era in Banking

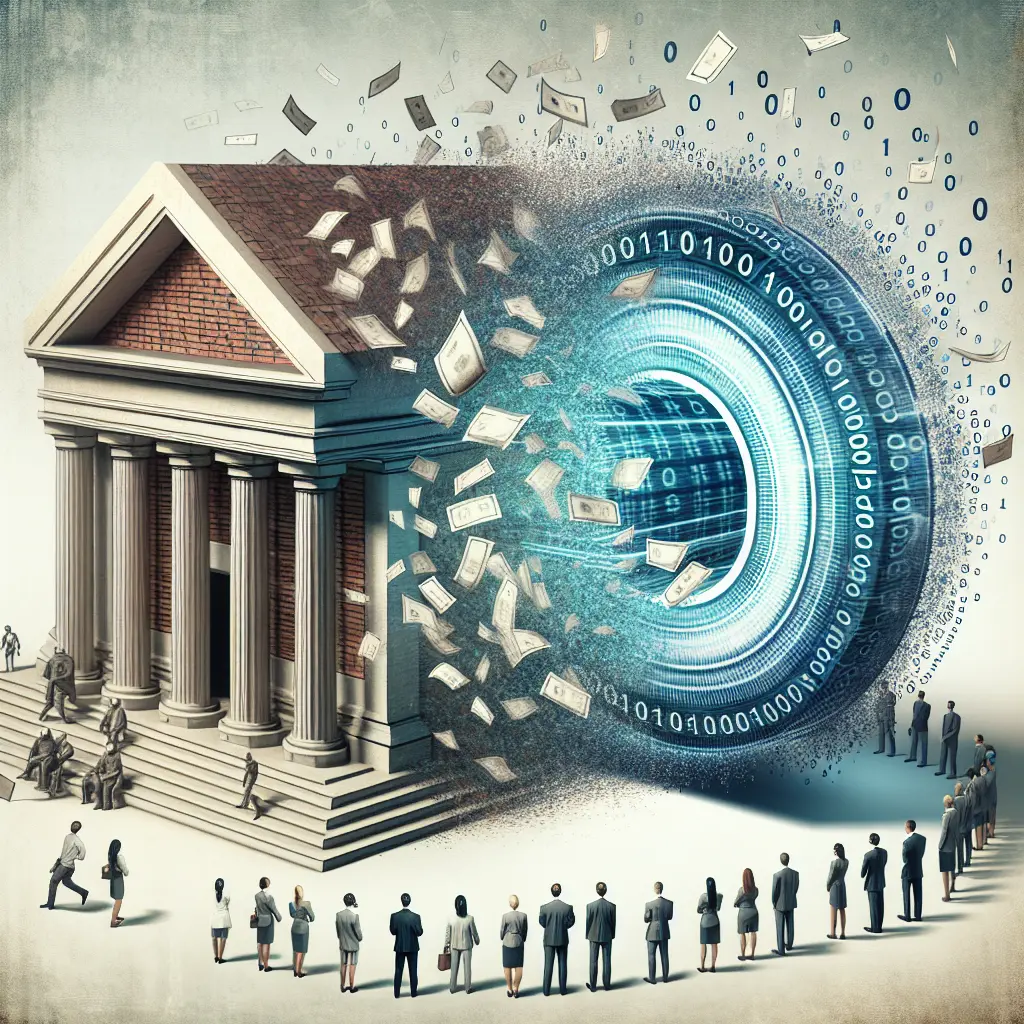

In recent years, the emergence of decentralized finance (DeFi) has sparked a revolution within the banking industry, compelling traditional banking systems to reconsider their operational models. As DeFi gains traction, its impact on conventional banks becomes increasingly evident, presenting both challenges and opportunities for financial institutions worldwide. This seismic shift is driven by blockchain technology, which facilitates secure and transparent transactions without the need for intermediaries. Consequently, DeFi financial services offer an innovative alternative to traditional banking practices.

The ongoing debate between DeFi and traditional banking underscores the transformative potential of decentralized finance. Traditional banks find themselves at a crossroads due to the rapid adoption of blockchain technology in banking. However, this disruption also presents opportunities for those willing to embrace change. The future of banking with DeFi looks promising for institutions ready to integrate this new wave of financial innovation into their frameworks.

Disruption and Opportunities: The DeFi Revolution

The decentralized finance revolution is characterized by its ability to provide secure, transparent transactions without intermediaries, a stark contrast to conventional banking practices. This fundamental shift has led to significant disruption in the banking sector, compelling banks to reconsider their operational models. A recent example of this shift is SunPump's initiative to enable the launching of meme coins on the Tron blockchain. This move signifies how DeFi financial services are expanding into niche markets, creating new avenues for innovation and investment.

For traditional banks, this disruption presents both challenges and opportunities. On one hand, banks face the daunting task of integrating blockchain technology, which often involves overcoming regulatory hurdles and security concerns. On the other hand, DeFi presents abundant opportunities for banks willing to adapt. By leveraging DeFi’s potential, banks can enhance their service offerings and remain competitive in a rapidly changing market.

Case Study: Israel’s High-Tech Scene

Israel’s high-tech scene offers an insightful case study into how traditional banks and DeFi are beginning to coexist. Known for its innovation and technological prowess, Israel has become a hub for DeFi projects. Israeli startups are increasingly integrating blockchain technology into their frameworks, spurring collaboration between fintech innovators and traditional banks. This collaboration demonstrates how banks can harness financial innovation from DeFi to enhance efficiency and customer satisfaction.

The integration of DeFi financial services into traditional banking systems in Israel highlights a growing trend: the convergence of technology and finance to create a more resilient financial ecosystem. As these partnerships flourish, they set a precedent for other countries looking to embrace the future of banking with DeFi.

Navigating Regulatory Challenges

Despite the promising outlook, significant challenges persist for banks integrating DeFi solutions. Regulatory compliance remains one of the most pressing issues, as regulations vary widely across jurisdictions. Banks must navigate a complex legal landscape to successfully adopt DeFi solutions while ensuring cybersecurity measures are robust enough to protect against potential threats inherent in decentralized systems.

The Trump family's rumored 'DeFiant' crypto project has sparked discussions about tokenization versus traditional banking, underscoring the regulatory hurdles that must be overcome to ensure seamless integration of DeFi into mainstream finance. As governments worldwide grapple with formulating clear policies, the banking industry and DeFi must work collaboratively to address these concerns.

Embracing Financial Innovation: A Path Forward

The path forward for traditional banks lies in embracing the financial innovation that DeFi offers. By adopting blockchain technology, institutions can streamline operations, reduce costs, and enhance transparency. The potential of DeFi adoption by banks is immense, offering a transformative shift towards more efficient financial services.

A notable example of this potential is the play-to-earn model explored by TapSwap's founder. This model highlights how blockchain technology can be leveraged to create new value propositions within the gaming industry, demonstrating the versatility of DeFi applications beyond traditional finance.

The Future of Banking with DeFi

As we look towards the future, the convergence of traditional banks and DeFi presents a unique opportunity to create a more inclusive and efficient financial system. The decentralized finance revolution shows no signs of slowing down, with new innovations continually emerging to challenge existing paradigms. However, for banks to fully realize the benefits of DeFi financial services, they must proactively address regulatory and security concerns.

Engaging with stakeholders across the financial sector is crucial for fostering an environment conducive to collaboration and growth. By understanding the implications of DeFi on traditional banking, professionals, enthusiasts, and general readers alike can better navigate this evolving landscape.

Conclusion: Charting a New Course

In conclusion, the impact of DeFi on traditional banking systems is profound and multifaceted. While challenges persist, the opportunities for those willing to embrace change are equally significant. As decentralized finance continues to reshape modern banking, institutions must remain agile and open to innovation. By doing so, they can ensure their relevance in an increasingly digital world and contribute to building a more robust and adaptable financial ecosystem.

Reflect on how your institution can leverage blockchain technology to enhance its service offerings. Your actions today could define your position in tomorrow's financial landscape.

We invite you to share your experiences and insights on navigating the DeFi revolution. How do you envision the future of banking in this rapidly evolving landscape? Join the conversation and explore more with reputable sources like Coindesk and Cointelegraph.

Author: Anthony Sullivan